SME’s need help!

The need for the government to help small and medium businesses is growing by the day as the lock-down continues. This has also been a key issue discussed during the daily virtual global-national brainstorming meetings being spearheaded by PIDE. How should the government help these SMEs during this pandemic and resulting economic slowdown?

In the previous discussion “Pakistan’s COVID-19 Response: What of the Small and Medium Enterprises?” the significance of helping SMEs was highlighted and questions were raised about adequacy of the government’s COVID-19 fiscal support package and about who will be spearheading cause of the SMEs. [https://empowerpakistanbyazd.blog/2020/03/31/pakistans-covid-19-response-what-of-the-small-and-medium-enterprises/]

SMEs matter to our economy!

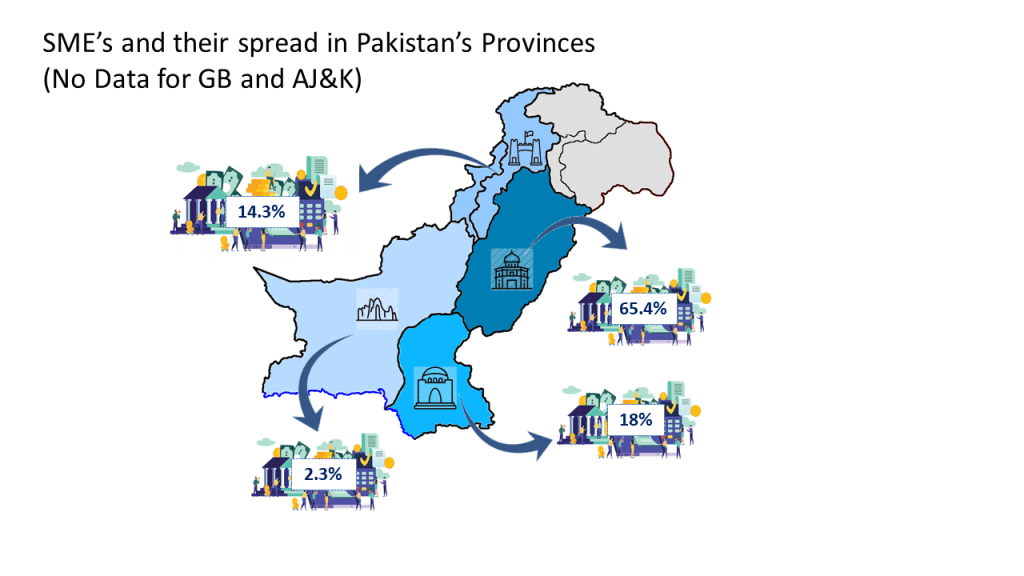

Allow me to refresh our collective memories. Somewhere between 3 and 4 million SMEs collectively provide 90 percent of the overall employment in Pakistan. Excluding the agriculture sector SMEs, 78 percent of the workforce is SME based. SMEs add 30 percent to 40 percent to the GDP of our country—depending on whose numbers you believe. They are spread in the proportion of our population across our provinces.

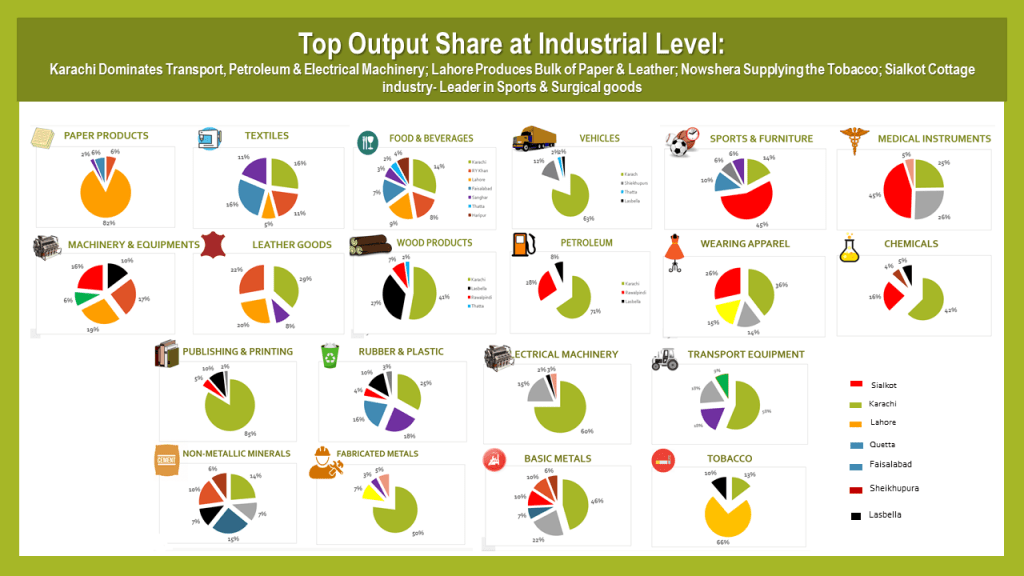

These SMEs are in almost every imaginable sector: 10 percent in Wood & Furniture; 4 percent in Jewelry; 16 percent in Grain Milling; 5 percent in Art Silk; 4 percent in Carpets; 7 percent in Metal Products; 13 percent in Cotton Weaving; 6 percent in Other Textiles; and 35 percent in Other Sectors.

This last “Other Sectors” is important. Technology and other start-ups, intellectual services providers, and so on constitute this “Other Sectors” category and are really where a lot of the employment for those with higher education is concentrated. The IT SMEs contributing to our exports fall within this category.

The CONVID-19 resultant layoffs will hurt SMEs more than the big-industry!

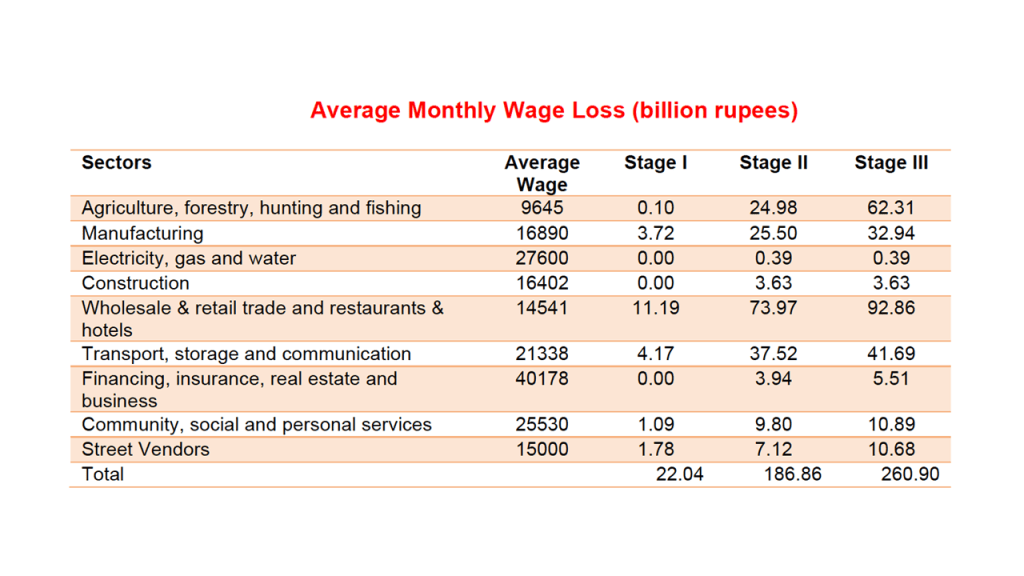

PIDE’s recent analyses in its recent CONVID-19 response bulletins on “Impact on Employment – Layoffs” [https://www.pide.org.pk/pdf/PIDE-COVID-Bulletin.pdf and https://www.pide.org.pk/pdf/PIDE-COVID-Bulletin-4.pdf] show the we are heading toward a vulnerable employed layoff in the neighborhood of 20 mil persons. Taking the range of estimates available, we have between 30 and 40 million Pakistanis employed by the SMEs. What the layoff estimates mean to SME sector is anyone’s guess, yet it would not be unreasonable to assume that almost a third to half of the SME sector employees are at risk if this slow down continues another month or so.

SMEs are not benefited by the post COVID-19 relief measures posited by the State Bank of Pakistan (SBP)

There is very little credit to the SME sector. SMEs finance is around 7 percent of the total private sector financing in Pakistan. The total outstanding SME financing per SME is barely 2.4milPKR per SME—way lower than even the allowed exposure of up to 25milPKR by SBP. This is further verified when we find that 83 percent of all credit by the SBP and scheduled banks is to the government sector (including State Owned Entities or SOEs). So, deferment of loan payments, lowering of interest rates, and other such financial measures really don’t by and large impact the SME sector of Pakistan.

| SME Financing by State Bank (Rs in Billion) | Jun 19 | Sep 19 |

| SME Financing (outstanding) | 464.86 | 422.12 |

| Domestic Private Sector Financing | 6,200.0 | 6121.1 |

| SME Financing as percentage of Private Sector Financing | 7.50% | 6.90% |

| SME NPL ratio | 17.04% | 18.95% |

| No. of SME borrowers | 183,606 | 182,149 |

Supporting Pakistani SMEs requires direct support to them through innovative approaches which may have multiple impacts

Government of Pakistan should directly offer to support the SMEs as follows.

A) Provide wage and rental subsidies to SMEs who have tax registration with FBR; this can be in the form of cash payments directly to SME employees and to lessors.

B) Advertise that all SMEs registering with FBR through a simplified registration procedure will get all the same subsidies.

As a start, both these measures will compliment the cash payment schemes for through the Kafalat program of Ehsas and will have a higher stabilization impact than supporting large businesses at this time.

Acknowledgements to contributors

Useful inputs for this blog were received from Ms. Uzma Zia (Senior Research Economist) and Dr Usman Qadir( Senior Research Economist), both at the PIDE.

References other than those listed above

Economic survey 2018-19

Akhtar S. H. Shah (2018) Framework for SME Sector Development in Pakistan, Planning Commission of Pakistan Ministry of Planning, Development & Reform Government of Pakistan

SBP website (http://www.sbp.org.pk/sme/index.htm)

Quarterly SME Finance Review(2019), SBP (http://www.sbp.org.pk/sme/PDF/DFG/2019/Sep.pdf)

SMEDA (https://smebank.org/media-center/sme-sectors-brief/)

Zafar, A., & Mustafa, S. (2017). SMEs and its role in economic and socio-economic development of Pakistan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 6(4).